Trading forex is not just about price. Which is how much market participants believe a market will move on an annualized basis.

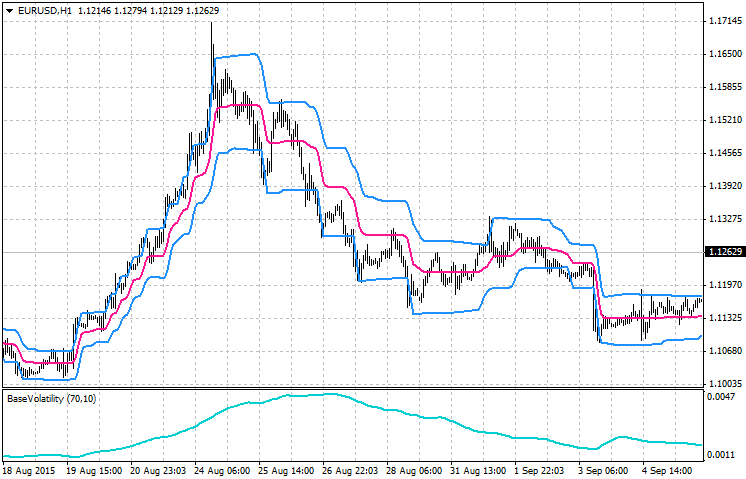

Trade Forex And Cfds With Volatility Protection Settings Admiral

Trade Forex And Cfds With Volatility Protection Settings Admiral

Type in the volatility criteria to find the least andor most volatile forex currencies in real time.

Forex price volatility. If you are an active currency options trader you will likely be aware of the implied volatility of each major currency pair. More traders t! rading at the same time usually results in the price making small movements up and down. You can switch the search mode to pips or percent.

Our forex movement chart provides an overview of recent price volatility for currency pairs commodities a simple measure of volatility for a selected currency pair or commodity. Every forex trader knows that profits in the foreign currency exchange market are made by buying at low price then selling at high price or selling at high price then buying at low price. A higher volatility means that an exchange rate can potentially be spread out over a larger range of values.

Volatile markets are characterized by sharp jumps in price and volatility breakout systems are designed to take advantage of this type of price action. The price of a currency option incorporates the market volatility of a currency pair. Volatility in forex trading refers to the amount of uncertainty or risk involved with the s! ize of changes in a currency exchange rate.

! There are a few indicators that can help you gauge a pairs current volatility. That is not to say that price isnt important but there are other elements to consider when planning a trade. You have to define the period to calculate the average of the volatility.

Oanda uses cookies to make our websites easy to use and customized to our visitors. Liquid markets such as forex tend to move in smaller increments because their high liquidity results in lower volatility. For example do the various characteristics of the fx currency pair in question suit your trading style.

Volatility measures the overall price fluctuations over a certain time and this information can be used to detect potential breakouts. Forex volatility the following table represent the currencys daily variation measured in pip in and in with a size of contract at 100000. A key characteristic you should consider is volatility.

Volatility is som! ething that we can use when looking for good breakout trade opportunities.

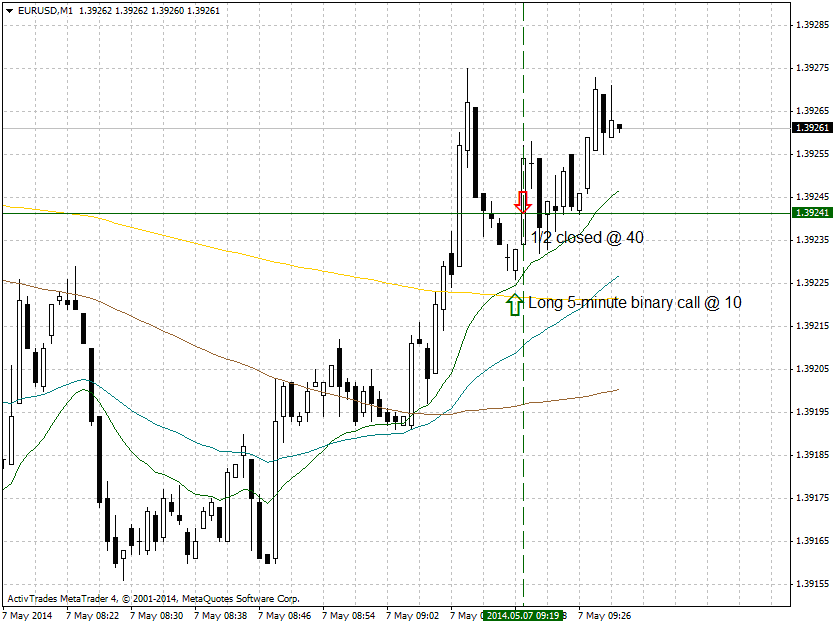

How To Measure Volatility In Forex Babypips Com

How To Measure Volatility In Forex Babypips Com

What Could Collapsing Currency Volatility Spell For The Forex Market

What Could Collapsing Currency Volatility Spell For The Forex Market

Dailyfx Blog Eur Usd Expect Us Nfp Jobs Data To Spark Forex

Dailyfx Blog Eur Usd Expect Us Nfp Jobs Data To Spark Forex

Forex Volatility Strategies Fx Leaders

Forex Volatility Strategies Fx Leaders

4 Types Of Forex Mt4 Indicators Every Trader Must Know

4 Types Of Forex Mt4 Indicators Every Trader Must Know

Forex Traders Fret As Sleepy Markets Slow To Calmest In Years Reuters

Forex Traders Fret As Sleepy Markets Slow To Calmest In Years Reuters

Pivot Points Alerts Timetotrade

Pivot Points Alerts Timetotrade

Sterling Volatility Crowns Brexit Unknowns

Sterling Volatility Crowns Brexit Unknowns

Golden Cross Formed Volatility Highest Since July 2016 New Forex Tips

Forex Oil Price Volatility Top 2018 Business Risks Kpmg

Forex Oil Price Volatility Top 2018 Business Risks Kpmg

Currency Volatility Forex Price Action Setups For Next Week

Currency Volatility Forex Price Action Setups For Next Week

Download Forex Data And Plot Rsi In Excel

Gold Us Dollar Threaten Breakout As Rate Volatility Spikes

Gold Us Dollar Threaten Breakout As Rate Volatility Spikes

.jpg) Major Forex Trading Indicators Mtrading

Major Forex Trading Indicators Mtrading

Volatility Jumps Across Fx Stocks Bonds Gold As Risks Rise

Volatility Jumps Across Fx Stocks Bonds Gold As Risks Rise